Family Guarantor Loans

Boost your deposit and avoid LMI by using a limited guarantee secured against a family member’s property.

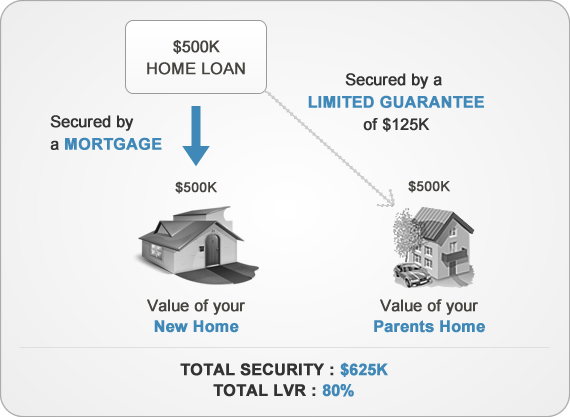

How is the mortgage for the guarantee structured?

The loan is secured by both the property that you are buying and the property owned by the guarantor. Using a limited guarantee can reduce the guarantor’s exposure to only the portion required to bring the overall LVR down (commonly to 80%).

Who can go guarantor?

Most banks accept parental guarantees. Some lenders may also consider immediate family (siblings, grandparents, spouses/de facto partners, or adult children). A small number will consider a non-family guarantor, subject to stricter assessment.

Limited Guarantee Calculator

This estimates the size of a limited guarantee and checks whether the guarantor has enough equity, based on an 80% LVR cap (editable).

This is an estimate only. Final figures depend on valuation, lender policy, and your full assessment.

Removing the guarantor

You can request release when your loan is ≤ 90% LVR (ideally ≤ 80%). This can be achieved by:

- Paying down the loan

- Capital growth increasing the property value

Release is subject to lender policy, updated valuation, and satisfactory conduct.

Benefits for borrowers

- Avoid LMI — potential savings of thousands of dollars

- Borrow more — boost effective deposit and costs

- Consolidate minor debts when purchasing (subject to ≤ 110% of price and lender policy)

- No cash deposit required — buy sooner

Considering a family guarantor loan?

I will map out structures, limit the guarantee, and confirm eligibility with suitable lenders.